Home › Resources › News ›

Headlines from NZ On Air’s “Where are the Audiences?” 2024 research

The latest wave of NZ On Air’s annual “Where Are The Audiences?” media research landed today. This annual report is fast becoming one of the most valuable longitudinal studies of New Zealand’s media consumption.

What does it show? The usual caveats with the data remain: it’s not designed to be as precise as other industry research sources including Nielsen Media Research or channel-specific research such as Radio’s gfk data which agencies like Together subscribe to. There’s also a 2% margin for error in the data so no celebrating or panicking should be done by any media owners from small changes. However, it is useful for longer term trend analysis and showing an overall shape to New Zealand’s evolving media consumption.

Here are some of the key findings and changes in the 2024 data compared to 2023:

- Year-on-Year Stability Amid Digital Dominance

Overall, the 2024 report shows a stabilization in most digital media channels after the rapid growth observed from 2021 to 2023. While the digital landscape continues to dominate, the slight declines or plateauing in reach across several platforms has offered glimmers of hope to local publishers that we may have reached a “peak platform” moment in New Zealand.

Our view is this is more reflective of a slowing and stabilising of post COVID behaviour, settling into a new normal after a period of rapid change forced by successive lockdowns. While it’s encouraging for local publishers, the long-term trends continue to demand urgent digital transformation.

- Global Video Sharing Platforms: Incremental Growth with Shifting Demographics

Global video sharing platforms, including YouTube and Facebook, continue to dominate with a daily reach of 64% in 2024, up from 63% in 2023. This growth is driven mainly by increased engagement among the 40-59 age group, while younger audiences show a slight decline in their use of these platforms.

We’re not calling it a two generational divide just yet, but the sense that we’re moving to a world in which first generation social platforms are slowing ageing thanks to natural generational behaviour and growing CTV penetration (especially useful for YouTube), while younger generations are gravitating to platforms like TikTok at the expense of Facebook is definitely playing out albeit in slow motion. Boomer social? Nearly.

- Television: A Decline in Linear Viewing, Stability in On-Demand

In isolation the data shows Linear Television is a staple for New Zealanders, with 60% daily reach in 2024, but this marks a decrease from 63% in 2023. The decline is driven by a continued drop in linear TV viewing, which saw its reach fall from 50% in 2023 to 47% in 2024. Reaching 60% of New Zealanders every day isn't to be sniffed at, but unlike other linear channels the downward graph isn't stabilising.

However, New Zealand Broadcaster Video on Demand (BVOD) platforms, such as TVNZ+ and ThreeNow, maintained their reach at 35% after a significant surge between 2021 and 2023. After a boom in the immediate post-COVID years, it appears that we’re reaching “peak on-demand” which is also playing out in SVOD numbers…

- Subscription Video on Demand (SVOD): A Small but Notable Decline

SVOD services like Netflix and Disney+ experienced a slight decrease in daily reach, from 57% in 2023 to 56% in 2024. This decline is more pronounced among viewers aged 40 and over, suggesting a potential saturation or “peak on-demand” threshold.

In a recessionary climate, and after years of booming trial behaviour sparked by COVID, SVOD services are under increasing consumer scrutiny.

- Radio: A Resurgence in Traditional Broadcast

In what may be seen as an unexpected shift, traditional broadcast radio saw an increase in daily reach, from 41% in 2023 to 42% in 2024. This contrasts with a slight decline in online radio, which dropped from 15% to 13% over the same period. The resurgence of broadcast radio highlights its enduring appeal, particularly among older audiences. It’s clear that while New Zealand remains a predominantly car-based country, linear radio will remain relatively stable. It’s also arguable that linear Radio is benefitting from the surge in TikTok, which is providing greater connection and engagement between listeners and radio hosts.

- Music Streaming: Stability with High Engagement

Music streaming services, led by Spotify, maintained a strong presence with a 49% daily reach in 2024, slightly down from 50% in 2023. Despite this small decline, the time spent streaming music continues to increase, with users now dedicating an average of 73 minutes per day, up from 69 minutes in 2023.

- Podcasts: Continued Growth in Reach and Influence

Podcast listening grew from 15% in 2023 to 18% in 2024, continuing a trend of steady growth since it was first measured in 2018. While time spent listening to podcasts has stabilized, the increased reach indicates that podcasts are becoming a more integral part of daily media consumption, especially among younger audiences. Once considered “magazines for the ears”, as our media choices fragment our ability to engage with our passions increases. Podcasting reflects this but what’s interesting is it appears to be additive to audio overall – it isn’t linear radio or podcast, but both.

- Connected TV Adoption: An Expanding Landscape

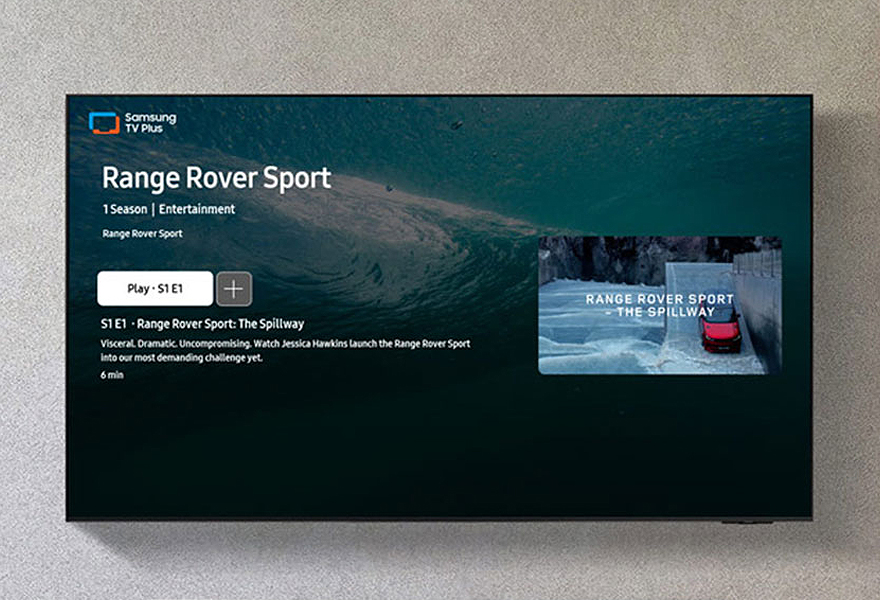

The data shows that the adoption of Connected TVs continues to rise, with nearly 60% of New Zealanders now owning or having access to a Connected TV. This goes hand in hand with the diversification of video consumption away from linear TV and the rise of older audiences engaging with YouTube. As CTV becomes the way most New Zealanders access video content, it continues to affirm the role CTV ad platforms like Samsung Ads and LG are now playing alongside the “traditional” on demand players. It’s clearly now time to acknowledge these “TV producers” as media heavyweights in their own right.

If you’ve got further questions on the 2024 data, get in touch.

To access the full research report head here: https://www.nzonair.govt.nz/research/where-are-the-audiences-2024/